Let’s Face It.

Processing Can Be Complicated.

But We’re Here To Help.

Our mission is to help merchants simplify their payment processing.

This means reducing complexities, fees, and headaches.

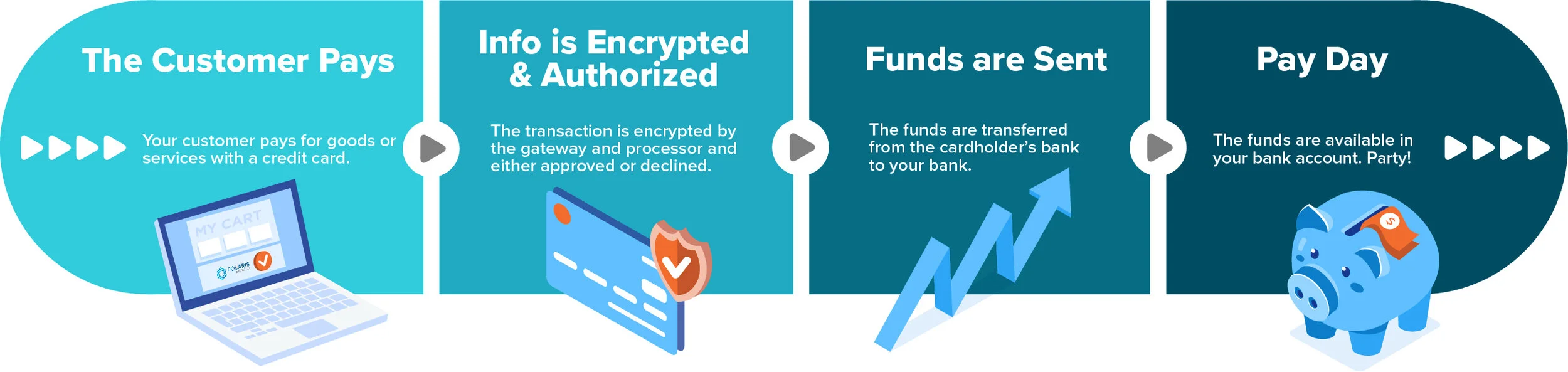

Where the money goes.

How the fees work.

Every business is different.

That’s why we help you determine

the best structure to fit your needs.

There are primarily three ways processors charge fees:

Interchange-Plus

Interchange fees from the card brands are passed directly on to your business. You pay a processing fee on this.

Fixed/Flat-Rate

As its name suggests, this pricing model charges your business a fixed rate for every transaction.

Tiered

These are typically three different categories: Qualified, Mid-Qualified, and Non-Qualified.

What are Interchange Fees?

Every time you accept a credit card, you pay a fee to a credit card processor. That fee has three parts: interchange, assessments, and processor markup. Interchange is the largest part, and it goes to the banks that issue cards to customers. It’s also non-negotiable; Visa and Mastercard set the interchange rates for accepting their cards.

In effect, interchange fees represent the “cost of doing business” if you accept credit cards. These charges are also known as the wholesale rate, since they are non-negotiable and don’t factor in additional markups.

What are Assessment Fees? (also known as Card Brand Fees)

These are fees the major card brands charge any time their cards are used. Like Interchange fees, these are set and not charged by Polaris Payments or any other processor. They are charged by the card brands themselves.

What are Tiered Rates?

There are over 100 different types of cards in circulation, and tiered rates break it down into three individual buckets:

Qualified Rate: This is typically a standard issued Visa or Master Card or debit card.

Mid-Qualified Rate: This is typically a rewards card, like a frequent flyer mile card for example.

Non-Qualified Rate: This is typically a corporate rewards card, foreign card, or a keyed-in card (for card-present setups).

What is Fixed/Flat Rate pricing?

This is a simple flat rate, for example 2.75%. You pay one flat rate for every transaction. All the fees mentioned above are included in this flat rate. Depending on the situation, Square can actually be a great solution for

a) low-average ticket merchants (say, sub $10) and

b) lower volume merchants (say, sub $5,000 per month).

c) merchants that don’t need as much personal support

We’re happy to help walk you through if an alternative like Square would be a better fit for you or not!